Product Description

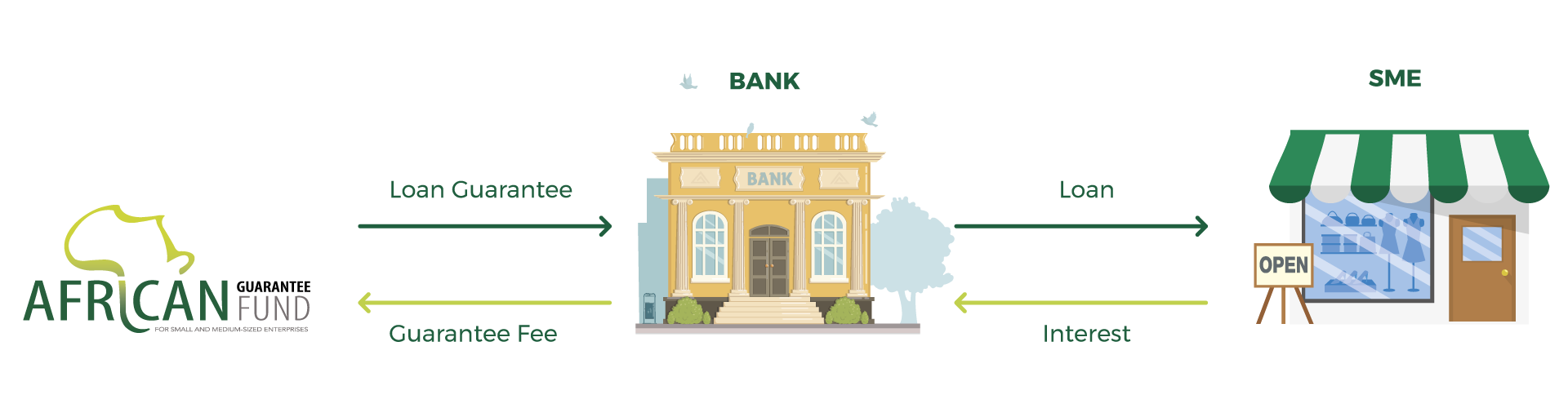

This is a facility that guarantees a loan made by a Partner Financial Institution to a qualifying borrower for which parameters have been defined and the proceeds go to a specific known borrower.

The Loan Individual Guarantee (LIG) enables the guaranteed party to scale-up its lending activities to the specific qualifying borrower.

Key Features

- Coverage: Up to 50%

- Limit: USD 2,500,000

Benefits

- Assists PFIs scale up their SME lending activities in situations where their target SME clients are unable to meet collateral threshold requirements;

- Improves the solvency (regulatory capital) ratios of banking partners and thus enabling them to have a better leverage on their capital;

Through the Capacity Development component of the LIG

- Develops and strengthens the skills, management practices, strategies, systems, competencies and abilities of PFIs to effectively increase their SME financing business;

- Assists SMEs enhance their business managerial capabilities especially in areas which include among others, governance, human capital management, quality control, packaging, financial management, and marketing

Eligibility Criteria

- The borrower must be a formally registered Small and Medium-sized Enterprise;

- The target of the Loan Individual Guarantee cuts across all sectors except the ones with an exception of those listed in AGF’s exclusion list.