Product Description

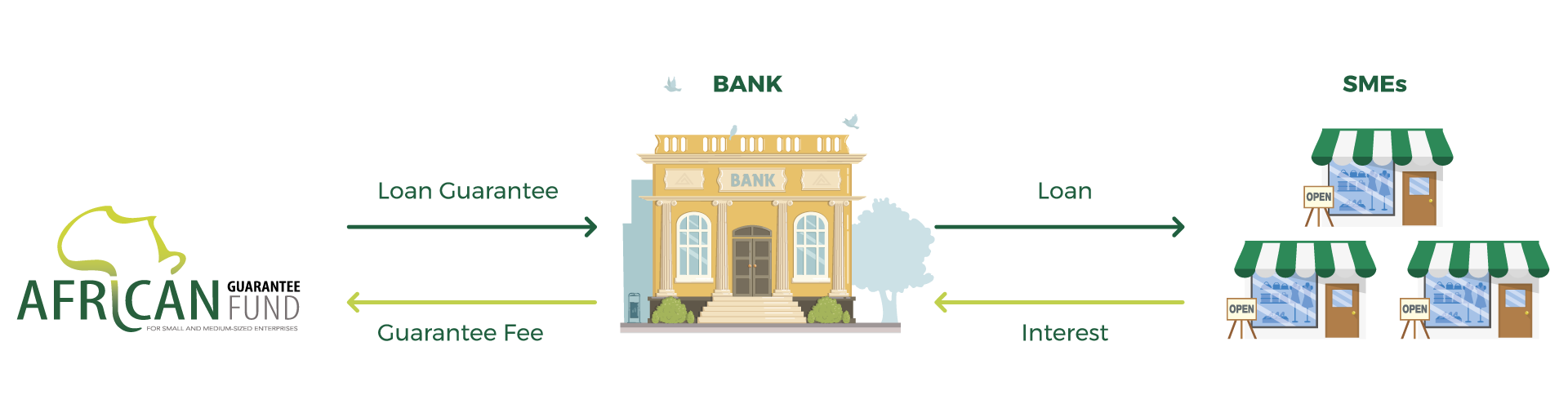

This is a facility that guarantees a portfolio of loans made by a Partner Financial Institution to qualifying borrowers for which the parameters have been defined but individual borrowers are not initially known.

The Loan Portfolio Guarantee (LPG) enables the guaranteed party to scale-up its lending activities to qualifying borrowers.

Key Features

- Coverage: Up to 50%

- USD 10,000,000

Benefits

- Assists PFIs scale up their SME lending activities in situations where their target SME clients are unable to meet collateral threshold requirements;

- Reduce the turnaround time required to place an SME facility under AGF’s cover;

- Improves the solvency (regulatory capital) ratios of banking partners and thus enabling them to have a better leverage on their capital;

Through the Capacity Development component of the LPG

- Develops and strengthens the skills, management practices, strategies, systems, competencies and abilities of PFIs to effectively increase their SME financing business;

- Assists SMEs enhance their business managerial capabilities especially in areas which include among others, governance, human capital management, quality control, packaging, financial management, and marketing

Eligibility Criteria

- The borrowers must be formally registered Small and Medium-sized Enterprises;

- The target of the Loan Portfolio Guarantee cuts across all sectors with an exception of those listed in AGF’s exclusion list.